Introduction

Chiavari chairs are a popular choice for trade shows and conventions due to their lightweight design and versatility. They are a great option for creating a comfortable and stylish seating area that can be easily moved and reconfigured. Chiavari chairs are also a great choice for events that require a large number of chairs, as they can be stacked and stored away when not in use. In this article, we will discuss the benefits of using Chiavari chairs for trade shows and conventions, as well as the potential drawbacks. We will also provide some tips on how to choose the right Chiavari chairs for your event.

How to Choose the Right Chiavari Chair for Your Trade Show or Convention

When it comes to selecting the right chairs for your trade show or convention, it is important to consider the type of chair that will best suit your needs. Chiavari chairs are a popular choice for events such as these, as they are both stylish and comfortable. Here are some tips to help you choose the right Chiavari chair for your trade show or convention.

First, consider the size of the chairs. Chiavari chairs come in a variety of sizes, so it is important to select chairs that will fit comfortably in the space you have available. Measure the area where the chairs will be placed and make sure to select chairs that will fit comfortably in the space.

Second, consider the material of the chairs. Chiavari chairs are typically made from wood, metal, or plastic. Each material has its own advantages and disadvantages, so it is important to select the material that best suits your needs. For example, wood chairs are more durable and can be stained or painted to match the decor of your event, while metal chairs are lightweight and easy to move.

Third, consider the style of the chairs. Chiavari chairs come in a variety of styles, from traditional to modern. Select a style that will complement the overall look and feel of your event.

Finally, consider the cost of the chairs. Chiavari chairs can range in price from very affordable to quite expensive. Consider your budget and select chairs that fit within it.

By following these tips, you can ensure that you select the right Chiavari chair for your trade show or convention. With the right chairs, you can create a comfortable and stylish atmosphere for your guests.

Benefits of Using Chiavari Chairs for Trade Shows and Conventions

Trade shows and conventions are important events for businesses to showcase their products and services to potential customers. To ensure that these events are successful, it is important to provide comfortable seating for attendees. Chiavari chairs are an ideal choice for trade shows and conventions, as they offer a variety of benefits.

First, Chiavari chairs are lightweight and easy to transport. This makes them ideal for trade shows and conventions, as they can be quickly and easily moved from one location to another. Additionally, they are stackable, which allows for efficient storage and transportation.

Second, Chiavari chairs are highly durable and can withstand heavy use. This makes them ideal for trade shows and conventions, as they can be used for multiple events without needing to be replaced. Additionally, they are easy to clean and maintain, which helps to ensure that they remain in good condition for years to come.

Third, Chiavari chairs are aesthetically pleasing. They come in a variety of colors and styles, which allows businesses to choose chairs that match their branding and decor. This helps to create a professional and inviting atmosphere for attendees.

Finally, Chiavari chairs are comfortable. They feature a curved backrest and seat, which provides support and comfort for attendees. This helps to ensure that attendees remain comfortable throughout the event, which can help to increase engagement and satisfaction.

Overall, Chiavari chairs are an ideal choice for trade shows and conventions. They are lightweight, durable, aesthetically pleasing, and comfortable, which makes them a great option for businesses looking to create a professional and inviting atmosphere for their events.

Tips for Setting Up Chiavari Chairs for Your Trade Show or Convention

1. Choose the right size chairs for your space. Chiavari chairs come in a variety of sizes, so make sure you select the right size for your trade show or convention space.

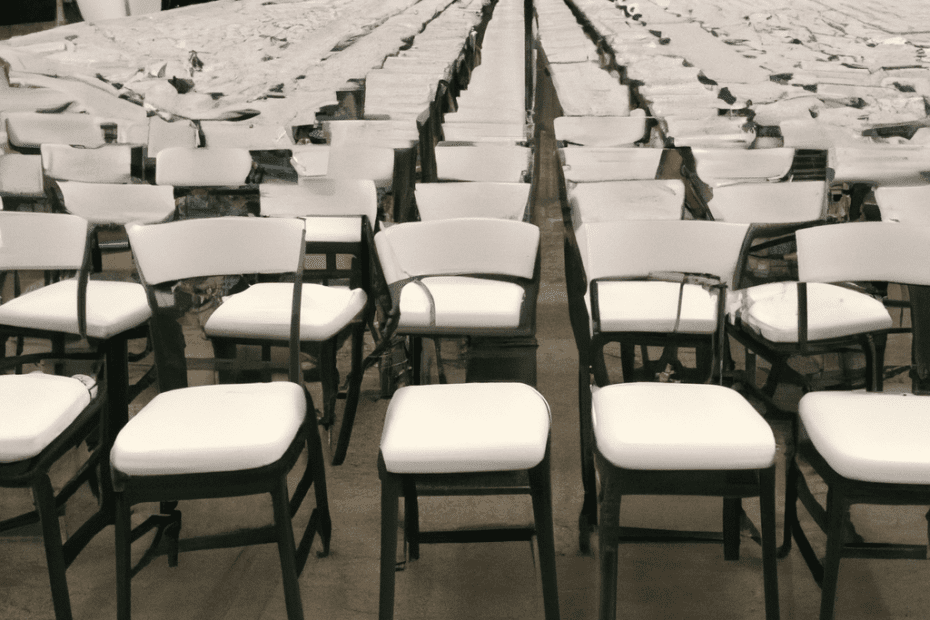

2. Set up the chairs in an organized fashion. Arrange the chairs in neat rows and columns to create an orderly and professional look.

3. Make sure the chairs are stable. Chiavari chairs are lightweight and can be easily moved, but make sure they are securely fastened to the floor or other surface to prevent them from tipping over.

4. Choose the right color for your chairs. Chiavari chairs come in a variety of colors, so choose a color that complements your trade show or convention theme.

5. Add cushions for extra comfort. If you want to provide extra comfort for your guests, consider adding cushions to the chairs.

6. Use chair covers for a more polished look. Chair covers can help to create a more polished and professional look for your trade show or convention.

7. Make sure the chairs are clean and in good condition. Before setting up the chairs, make sure they are clean and free of any damage or wear and tear.

8. Consider adding decorations. Chiavari chairs can be decorated with ribbons, flowers, or other decorations to create a more festive atmosphere.

How to Maximize Comfort and Style with Chiavari Chairs at Your Trade Show or Convention

Trade shows and conventions are important events for businesses to showcase their products and services. To ensure that your booth stands out from the competition, it is important to create a comfortable and stylish atmosphere. Chiavari chairs are an excellent way to maximize comfort and style at your trade show or convention.

Chiavari chairs are a classic seating option that have been used for centuries. They are lightweight, stackable, and come in a variety of colors and finishes. The chairs are also designed to be comfortable, with a curved back and armrests for added support.

When selecting Chiavari chairs for your trade show or convention, it is important to consider the overall look and feel of your booth. Choose chairs that complement the colors and design of your booth, as well as the products and services you are showcasing. You can also add cushions or covers to the chairs to add a touch of style and comfort.

In addition to selecting the right chairs, it is important to arrange them in a way that is both comfortable and inviting. Place the chairs in a circle or semi-circle to create a conversational atmosphere. This will encourage people to stay and chat, rather than just passing through.

Finally, make sure that the chairs are easily accessible. Place them close to the entrance of your booth so that visitors can easily find them. This will ensure that everyone has a comfortable place to sit and relax while they learn more about your business.

Chiavari chairs are an excellent way to maximize comfort and style at your trade show or convention. With the right selection and arrangement, these chairs can help create an inviting atmosphere that will draw in visitors and help your business stand out from the competition.

The Advantages of Using Chiavari Chairs for Trade Shows and Conventions

Chiavari chairs are a popular choice for trade shows and conventions due to their versatility and convenience. These chairs are lightweight, stackable, and easy to transport, making them ideal for events that require a large number of chairs. Additionally, they are available in a variety of colors and styles, allowing for a customized look that will fit any event.

Chiavari chairs are also extremely comfortable, making them a great choice for long events. The chairs are designed with a curved back and seat, providing support for the back and legs. The chairs also feature a padded seat, making them comfortable to sit in for extended periods of time.

The chairs are also very durable, making them a great investment for events that will be used multiple times. The chairs are made from high-quality materials, such as aluminum and wood, and are designed to withstand heavy use. Additionally, the chairs are easy to clean and maintain, making them a great choice for events that require frequent cleaning.

Finally, Chiavari chairs are an affordable option for trade shows and conventions. The chairs are available in a variety of price points, making them accessible to any budget. Additionally, the chairs are easy to assemble and disassemble, making them a great choice for events that require frequent setup and breakdown.

Overall, Chiavari chairs are an ideal choice for trade shows and conventions due to their versatility, comfort, durability, and affordability. The chairs are lightweight, stackable, and easy to transport, making them ideal for events that require a large number of chairs. Additionally, the chairs are comfortable, durable, and easy to clean and maintain, making them a great investment for events that will be used multiple times. Finally, the chairs are available in a variety of price points, making them accessible to any budget.

How to Choose the Right Size Chiavari Chair for Your Trade Show or Convention

When planning a trade show or convention, selecting the right size Chiavari chair is an important decision. Chiavari chairs are a popular choice for events due to their elegant design and versatility. However, it is important to choose the right size chair to ensure that your guests are comfortable and that the chairs fit in the space you have available.

The first step in selecting the right size Chiavari chair is to measure the space you have available. Measure the length and width of the area where the chairs will be placed. This will help you determine the maximum size of the chairs that will fit in the space.

Next, consider the size of your guests. Chiavari chairs come in a variety of sizes, from small to large. If you are hosting a large event, you may want to consider larger chairs to accommodate larger guests. On the other hand, if you are hosting a smaller event, you may want to opt for smaller chairs.

Finally, consider the type of event you are hosting. If you are hosting a formal event, you may want to opt for larger chairs with a more formal design. For a more casual event, smaller chairs with a more casual design may be more appropriate.

By taking the time to measure the space you have available, consider the size of your guests, and consider the type of event you are hosting, you can ensure that you select the right size Chiavari chair for your trade show or convention.

How to Care for and Maintain Chiavari Chairs for Trade Shows and Conventions

Chiavari chairs are a popular choice for trade shows and conventions due to their lightweight design and elegant appearance. However, in order to ensure that these chairs remain in good condition, it is important to take proper care and maintenance measures. Here are some tips for caring for and maintaining Chiavari chairs for trade shows and conventions.

First, it is important to inspect the chairs before and after each use. Look for any signs of wear and tear, such as loose screws, frayed fabric, or broken parts. If any of these issues are found, they should be addressed immediately.

Second, it is important to keep the chairs clean. Dust and dirt can accumulate on the chairs over time, so it is important to wipe them down with a damp cloth regularly. Additionally, it is important to use a mild detergent and warm water to clean the chairs if they become stained.

Third, it is important to store the chairs properly. Chiavari chairs should be stored in a cool, dry place away from direct sunlight. Additionally, it is important to stack the chairs properly to avoid any damage.

Finally, it is important to use the right type of lubricant on the chairs. A silicone-based lubricant should be used on the moving parts of the chairs to ensure that they move smoothly.

By following these tips, you can ensure that your Chiavari chairs remain in good condition for trade shows and conventions. With proper care and maintenance, these chairs can last for many years.

The Benefits of Using Chiavari Chairs for Trade Show and Convention Booths

Chiavari chairs are a popular choice for trade show and convention booths due to their versatility and convenience. These chairs offer a variety of benefits that make them an ideal choice for any event.

First, Chiavari chairs are lightweight and easy to transport. This makes them ideal for trade shows and conventions, where they must be moved from one booth to another. They are also stackable, which makes them easy to store and transport. This makes them a great choice for events that require a large number of chairs.

Second, Chiavari chairs are highly customizable. They come in a variety of colors and styles, allowing you to create a unique look for your booth. This makes them perfect for creating a professional and attractive atmosphere.

Third, Chiavari chairs are comfortable and durable. They are designed to provide support and comfort for long periods of time. This makes them ideal for trade shows and conventions, where attendees may be sitting for extended periods of time.

Finally, Chiavari chairs are cost-effective. They are relatively inexpensive compared to other types of chairs, making them a great choice for any budget.

Overall, Chiavari chairs are an excellent choice for trade show and convention booths. They are lightweight, customizable, comfortable, and cost-effective, making them an ideal choice for any event.

How to Choose the Right Color Chiavari Chair for Your Trade Show or Convention

When planning a trade show or convention, selecting the right color chiavari chair is an important decision. The right color can help create a cohesive look and feel for the event, while the wrong color can detract from the overall atmosphere. Here are some tips to help you choose the right color chiavari chair for your trade show or convention.

First, consider the overall theme of the event. If the event has a specific color scheme, then you should choose a chiavari chair that complements the colors of the event. For example, if the event has a blue and white theme, then you should choose a blue or white chiavari chair.

Second, consider the type of event. If the event is a formal affair, then you should choose a more traditional color such as black or mahogany. If the event is more casual, then you can choose a brighter color such as red or yellow.

Third, consider the size of the event. If the event is large, then you should choose a color that will stand out and be visible from a distance. If the event is smaller, then you can choose a more subtle color.

Finally, consider the overall atmosphere of the event. If the event is more formal, then you should choose a more traditional color such as black or mahogany. If the event is more casual, then you can choose a brighter color such as red or yellow.

By following these tips, you can easily choose the right color chiavari chair for your trade show or convention. With the right color, you can create a cohesive look and feel for the event that will make it memorable for all attendees.

How to Create a Professional Look with Chiavari Chairs at Your Trade Show or Convention

Creating a professional look at your trade show or convention is essential for making a good impression on potential customers and partners. Chiavari chairs are a great way to achieve this goal. These chairs are lightweight, stackable, and come in a variety of colors and finishes, making them perfect for any event. Here are some tips for creating a professional look with Chiavari chairs at your trade show or convention.

1. Choose the Right Color: Chiavari chairs come in a variety of colors, so it’s important to choose the right one for your event. Consider the overall color scheme of your event and choose a color that will complement it.

2. Consider the Finish: Chiavari chairs come in a variety of finishes, from glossy to matte. Choose a finish that will match the overall look and feel of your event.

3. Add Accessories: Chiavari chairs can be dressed up with accessories such as chair covers, sashes, and cushions. These accessories can add a touch of elegance to your event and make your chairs look more professional.

4. Arrange the Chairs Properly: Make sure to arrange the chairs in an orderly fashion. This will create a more professional look and make it easier for guests to find their seats.

By following these tips, you can create a professional look with Chiavari chairs at your trade show or convention. Chiavari chairs are a great way to add a touch of elegance to any event and make a good impression on potential customers and partners.

Q&A

1. Can I use Chiavari chairs for my trade show or convention?

Yes, Chiavari chairs are a great option for trade shows and conventions. They are lightweight, stackable, and come in a variety of colors and finishes.

2. What are the benefits of using Chiavari chairs for my trade show or convention?

Chiavari chairs are a great option for trade shows and conventions because they are lightweight, stackable, and come in a variety of colors and finishes. They are also very comfortable and can be easily moved around the event space.

3. Are Chiavari chairs durable enough for a trade show or convention?

Yes, Chiavari chairs are very durable and can withstand the wear and tear of a trade show or convention. They are made of high-quality materials and are designed to last.

4. How much do Chiavari chairs cost?

The cost of Chiavari chairs varies depending on the size, color, and finish. Generally, they range from $50 to $200 per chair.

5. Are Chiavari chairs easy to set up and take down?

Yes, Chiavari chairs are very easy to set up and take down. They are lightweight and stackable, so they can be quickly moved around the event space.

6. Are Chiavari chairs comfortable?

Yes, Chiavari chairs are very comfortable. They are designed with ergonomic features and are made of high-quality materials.

7. Are Chiavari chairs safe to use?

Yes, Chiavari chairs are safe to use. They are designed with safety features and are made of high-quality materials.

8. Are Chiavari chairs easy to clean?

Yes, Chiavari chairs are very easy to clean. They are made of high-quality materials that are easy to wipe down and keep clean.

9. Are Chiavari chairs customizable?

Yes, Chiavari chairs can be customized with different colors, finishes, and fabrics.

10. Are Chiavari chairs a good value for the money?

Yes, Chiavari chairs are a great value for the money. They are lightweight, stackable, and come in a variety of colors and finishes. They are also very comfortable and can be easily moved around the event space.

Conclusion

In conclusion, Chiavari chairs can be a great option for trade shows and conventions. They are lightweight, easy to transport, and can be used to create a stylish and professional look. Additionally, they are comfortable and can be used to create a variety of seating arrangements. With careful consideration of the space and budget, Chiavari chairs can be a great choice for any trade show or convention.

- how to paint chiavari chairs - April 8, 2024

- how to make chiavari chairs - April 8, 2024

- how to decorate chiavari chairs - April 8, 2024