Introduction

Painting chiavari chairs is a great way to add a unique touch to your event or home decor. Chiavari chairs are a popular choice for weddings, parties, and other special occasions. With a few simple steps, you can easily transform your chiavari chairs into a beautiful and unique piece of furniture. In this guide, we will provide you with the necessary steps and materials needed to paint your chiavari chairs. With the right tools and a bit of patience, you can create a stunning piece of furniture that will be the envy of all your guests.

How to Choose the Right Paint for Chiavari Chairs

When it comes to choosing the right paint for Chiavari chairs, there are a few important factors to consider. First, you need to decide what type of paint you want to use. There are several options available, including oil-based, water-based, and spray paint. Each type of paint has its own advantages and disadvantages, so it is important to choose the one that best suits your needs.

Second, you need to consider the color of the paint. Chiavari chairs come in a variety of colors, so you should choose a paint color that complements the chair’s existing color. If you are painting a light-colored chair, you may want to choose a lighter shade of paint. If you are painting a dark-colored chair, you may want to choose a darker shade of paint.

Third, you need to consider the finish of the paint. There are several different finishes available, including gloss, semi-gloss, and matte. Gloss paint will give the chair a shiny, glossy look, while semi-gloss and matte finishes will give the chair a more subtle, muted look.

Finally, you need to consider the durability of the paint. Chiavari chairs are often used in high-traffic areas, so it is important to choose a paint that is durable and long-lasting. Oil-based paints are generally the most durable, but they can be difficult to clean and may require more frequent touch-ups. Water-based paints are easier to clean and may require less frequent touch-ups, but they are not as durable as oil-based paints.

By taking the time to consider these factors, you can ensure that you choose the right paint for your Chiavari chairs. With the right paint, your chairs will look great and last for years to come.

Preparing Chiavari Chairs for Painting

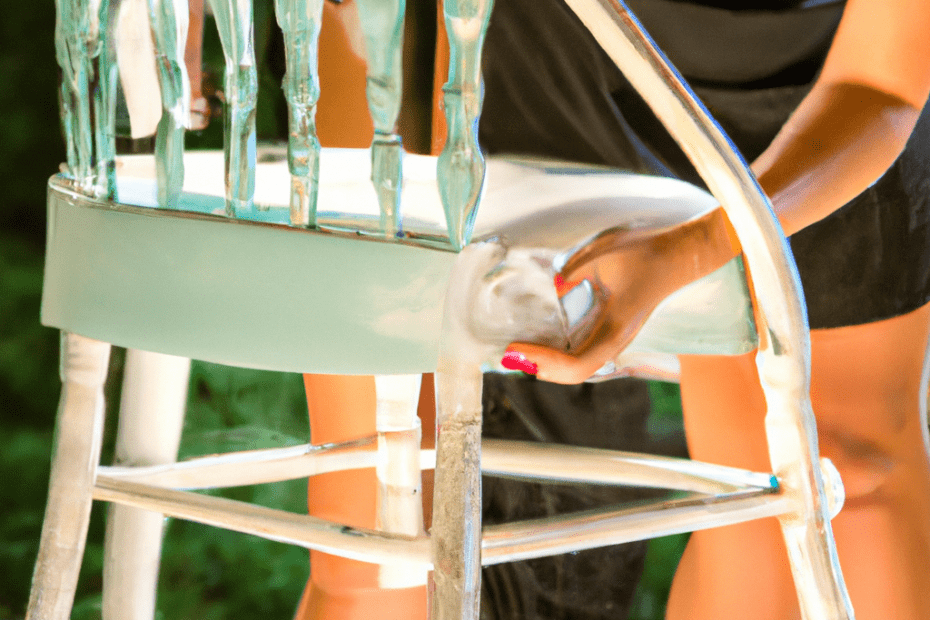

Painting Chiavari chairs is a great way to give them a new look and add a personal touch to your event space. Before you begin painting, it is important to properly prepare the chairs for the best results.

First, remove any dust or dirt from the chairs with a damp cloth. Make sure to get into all the crevices and corners. Once the chairs are clean, lightly sand them with a fine-grit sandpaper. This will help the paint adhere better and create a smoother finish.

Next, use a tack cloth to remove any dust or debris left from sanding. Once the chairs are completely clean, apply a coat of primer. This will help the paint adhere better and provide a better base for the paint. Allow the primer to dry completely before moving on to the next step.

Finally, apply the paint of your choice. Use a brush or roller to apply the paint in even strokes. Make sure to cover all areas of the chair, including the legs and arms. Allow the paint to dry completely before using the chairs.

By following these steps, you can ensure that your Chiavari chairs are properly prepared for painting. This will help you achieve a professional-looking finish that will last for years to come.

Tips for Applying Paint Evenly to Chiavari Chairs

1. Start by cleaning the chairs with a damp cloth to remove any dust or dirt.

2. Sand the chairs lightly with a fine-grit sandpaper to create a smooth surface for the paint to adhere to.

3. Apply a coat of primer to the chairs and allow it to dry completely before painting.

4. Use a high-quality paintbrush to apply the paint in even strokes. Start at the top of the chair and work your way down.

5. Allow the first coat of paint to dry completely before applying a second coat.

6. To ensure an even finish, use a foam roller to apply the second coat of paint.

7. Allow the paint to dry completely before using the chairs.

8. To protect the paint, apply a coat of sealant or varnish.

How to Create a Custom Color for Chiavari Chairs

Creating a custom color for Chiavari chairs is a great way to add a unique touch to any event. Whether you’re hosting a wedding, a corporate event, or a special occasion, customizing the color of your chairs can help to create a memorable atmosphere. Here are the steps to creating a custom color for Chiavari chairs.

1. Choose a Base Color: Start by selecting a base color for your chairs. This will be the main color of the chairs and will be the foundation for the custom color.

2. Select a Colorant: Once you’ve chosen a base color, you’ll need to select a colorant. This is the pigment that will be used to create the custom color.

3. Mix the Colorant: Once you’ve selected a colorant, you’ll need to mix it with the base color. This can be done by using a paint mixer or a hand-held mixer.

4. Apply the Color: Once the colorant has been mixed with the base color, it’s time to apply it to the chairs. This can be done with a brush or a spray gun.

5. Allow the Color to Dry: After the color has been applied, it’s important to allow it to dry completely before using the chairs. This will ensure that the color is set and won’t fade or rub off.

Creating a custom color for Chiavari chairs is a great way to add a unique touch to any event. By following these steps, you can easily create a custom color that will make your event stand out.

The Benefits of Using Primer on Chiavari Chairs

Chiavari chairs are a popular choice for events such as weddings, banquets, and other special occasions. They are lightweight, elegant, and easy to transport, making them a great option for any event. However, to ensure that your chairs look their best, it is important to use a primer before painting them. Primer helps to protect the chairs from scratches, dents, and other damage, and it also helps the paint to adhere better to the surface. Here are some of the benefits of using primer on Chiavari chairs.

First, primer helps to protect the chairs from damage. It acts as a barrier between the paint and the chair, preventing scratches and dents from occurring. This is especially important if you plan to use the chairs outdoors, as they will be exposed to the elements. Primer also helps to prevent the paint from fading or chipping over time.

Second, primer helps the paint to adhere better to the surface of the chairs. Without primer, the paint may not stick as well, resulting in a less than perfect finish. Primer also helps to create a smoother surface, which makes it easier to apply the paint evenly.

Finally, primer helps to create a more vibrant color. Without primer, the paint may appear dull or faded. Primer helps to create a brighter, more vibrant color that will last for years to come.

Using primer on Chiavari chairs is an important step in ensuring that your chairs look their best. Primer helps to protect the chairs from damage, helps the paint to adhere better, and creates a more vibrant color. With primer, your chairs will look great for years to come.

How to Achieve a Professional Finish on Chiavari Chairs

Chiavari chairs are a popular choice for events and weddings due to their elegant and timeless design. To ensure a professional finish, there are several steps that should be taken when preparing and setting up the chairs.

First, it is important to inspect the chairs for any damage or wear and tear. If any damage is found, it should be repaired before the chairs are set up. This will ensure that the chairs look their best and will not be a distraction during the event.

Next, the chairs should be wiped down with a damp cloth to remove any dust or dirt. This will help to ensure that the chairs look clean and polished.

Once the chairs have been cleaned, they should be polished with a furniture polish. This will help to protect the chairs from scratches and will also give them a glossy finish.

Finally, the chairs should be set up in an orderly fashion. This will help to create a professional and organized look. It is also important to make sure that the chairs are evenly spaced and that the legs are all level.

By following these steps, you can ensure that your Chiavari chairs have a professional finish. This will help to create a beautiful and elegant atmosphere for your event.

The Best Way to Seal Painted Chiavari Chairs

When it comes to protecting painted Chiavari chairs, the best way to ensure their longevity is to seal them with a clear coat of polyurethane. This will help to protect the paint from scratches, fading, and other damage.

The first step in sealing painted Chiavari chairs is to clean the chairs thoroughly. Use a damp cloth to remove any dirt or dust from the surface of the chairs. Once the chairs are clean, allow them to dry completely before proceeding.

Next, apply a thin coat of polyurethane to the chairs. Use a brush or roller to apply the polyurethane in even strokes. Allow the first coat to dry completely before applying a second coat.

Once the second coat of polyurethane is dry, inspect the chairs for any missed spots or areas that need additional coverage. If necessary, apply a third coat of polyurethane.

Finally, allow the chairs to dry completely before using them. This will ensure that the polyurethane has had time to cure and that the chairs are properly sealed.

By following these steps, you can ensure that your painted Chiavari chairs are properly sealed and protected from damage. This will help to extend the life of your chairs and keep them looking their best for years to come.

How to Clean and Maintain Painted Chiavari Chairs

Maintaining painted Chiavari chairs is an important part of keeping them looking their best. With proper care and maintenance, these chairs can last for years. Here are some tips for cleaning and maintaining painted Chiavari chairs.

1. Dust Regularly: Dusting your chairs regularly is the best way to keep them looking their best. Use a soft cloth or feather duster to remove dust and dirt from the chairs.

2. Clean Spills Immediately: If a spill occurs, clean it up immediately. Use a damp cloth to wipe up the spill and then dry the area with a clean cloth.

3. Avoid Harsh Cleaners: Harsh cleaners can damage the paint on your chairs. Use a mild soap and water solution to clean the chairs.

4. Avoid Abrasive Materials: Abrasive materials such as steel wool or scouring pads can scratch the paint on your chairs. Use a soft cloth or sponge to clean the chairs.

5. Avoid Direct Sunlight: Direct sunlight can cause the paint on your chairs to fade. Keep your chairs out of direct sunlight when possible.

6. Wax Regularly: Waxing your chairs regularly will help protect the paint and keep them looking their best. Use a high-quality furniture wax and apply it in a thin, even layer.

By following these tips, you can keep your painted Chiavari chairs looking their best for years to come. With proper care and maintenance, these chairs can last for many years.

Troubleshooting Common Painting Problems on Chiavari Chairs

Painting Chiavari chairs can be a great way to add a unique touch to your event space. However, it is important to be aware of some common painting problems that can occur. This article will provide an overview of some of the most common painting problems and how to troubleshoot them.

1. Paint Not Adhering Properly: If the paint is not adhering properly to the surface of the Chiavari chair, it could be due to a few different factors. First, make sure that the surface of the chair is clean and free of any dirt or debris. If the surface is not properly cleaned, the paint may not adhere properly. Additionally, make sure that the paint is the correct type for the surface of the chair. If the paint is not suitable for the material, it may not adhere properly.

2. Paint Cracking or Peeling: If the paint is cracking or peeling, it could be due to a few different factors. First, make sure that the paint is applied in thin, even coats. If the paint is applied too thickly, it can cause the paint to crack or peel. Additionally, make sure that the paint is completely dry before applying a second coat. If the paint is not completely dry, it can cause the paint to crack or peel.

3. Paint Not Drying Properly: If the paint is not drying properly, it could be due to a few different factors. First, make sure that the paint is applied in thin, even coats. If the paint is applied too thickly, it can cause the paint to take longer to dry. Additionally, make sure that the room temperature is not too hot or too cold. If the temperature is too extreme, it can cause the paint to take longer to dry.

By following these tips, you can help ensure that your Chiavari chairs look their best. If you are still having trouble with painting your chairs, it may be best to consult a professional for assistance.

Creative Ideas for Painting Chiavari Chairs

Painting Chiavari chairs is a great way to add a unique touch to any event. Whether you are looking to create a bold statement or a subtle accent, there are many creative ideas for painting Chiavari chairs. Here are some tips to help you get started.

1. Use a bold color. Choose a bright, vibrant color to make a bold statement. Consider using a bright yellow, orange, or pink to create a cheerful atmosphere.

2. Create a pattern. Use stencils or tape to create a pattern on the chairs. You can use stripes, polka dots, or any other pattern you can think of.

3. Use metallic paint. Metallic paint can add a touch of glamour to your chairs. Consider using gold, silver, or copper to create a luxurious look.

4. Paint a mural. If you are feeling creative, you can paint a mural on the chairs. This is a great way to add a personal touch to your event.

5. Use chalkboard paint. Chalkboard paint is a great way to add a fun, interactive element to your event. Guests can write messages or draw pictures on the chairs.

Painting Chiavari chairs is a great way to add a unique touch to any event. With these creative ideas, you can create a look that is sure to impress your guests.

Q&A

1. What type of paint should I use to paint chiavari chairs?

You should use a high-quality, water-based acrylic paint for the best results.

2. How should I prepare the chairs before painting?

You should clean the chairs with a mild detergent and water, then sand them lightly with fine-grit sandpaper.

3. Do I need to use a primer before painting?

Yes, it is recommended to use a primer before painting to ensure the paint adheres properly.

4. How many coats of paint should I apply?

It is recommended to apply two coats of paint for the best results.

5. How long should I wait between coats?

You should wait at least 24 hours between coats to ensure the paint has dried completely.

6. How should I apply the paint?

You should use a brush or roller to apply the paint in even strokes.

7. How long should I wait before using the chairs?

You should wait at least 48 hours before using the chairs to ensure the paint has dried completely.

8. Can I use spray paint to paint chiavari chairs?

Yes, you can use spray paint, but it is not recommended as it can be difficult to get an even finish.

9. Can I paint the chairs outdoors?

Yes, you can paint the chairs outdoors, but you should make sure the area is well-ventilated and protected from the elements.

10. What type of finish should I use?

You should use a clear, water-based sealer to protect the paint and give it a glossy finish.

Conclusion

Painting chiavari chairs is a great way to add a unique touch to any event. With the right tools and techniques, you can easily transform a plain chair into a beautiful piece of furniture. Start by sanding the chair to create a smooth surface, then use a primer to ensure the paint adheres properly. Once the primer is dry, apply a coat of paint and let it dry completely before adding a second coat. Finally, seal the paint with a clear coat to protect it from wear and tear. With a little bit of patience and creativity, you can create a stunning piece of furniture that will be the envy of all your guests.

- how to paint chiavari chairs - April 8, 2024

- how to make chiavari chairs - April 8, 2024

- how to decorate chiavari chairs - April 8, 2024